(Photo by Emre Can Acer)

How Bitcoin will lower property prices in the coming decades

It’s not news to anyone that buying or renting a house is increasingly difficult. When we compare the increase in purchasing power with the increase in property prices, it becomes clear that fewer and fewer people will own their home in the coming years.

But the solution to this could be much simpler than a reform of the economic system or government measures: it could occur organically because of Bitcoin.

The reason for the rise in property prices

The reason why properties increasingly increase in value is the basic principle of economics: supply and demand. But this demand for real estate grows unnaturally due to the increase in the monetary base.

And what is the increase in the monetary base? Simple: it’s when the government prints money. Imagine that you and your friends have 10 coins each and need to exchange stickers with each other. If you mysteriously come up with a coin making machine, you can make coins infinitely and buy all the stickers you want.

But the result is that prices will readjust over time: when 1000 coins are in circulation between you and your friends, the average price of each sticker will increase. After all, why charge 10 coins for a sticker if there are people who can pay more?

And who will benefit from all this? Exactly, whoever can make the coins whenever they want, making competition completely unfair for those who don’t have that power.

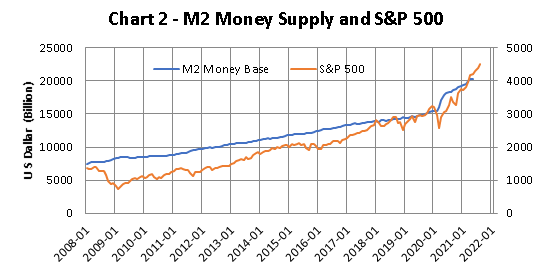

The same happens in the economy: in recent decades, the government has been printing more and more money to pay its debts. As a result, the government can spend more and more and money is worth less and less. See the growth in the number of dollars in existence around the world over time:

Do you notice how there are more dollars in circulation? But dollars can be multiplied indefinitely, while properties take months or years to be built. As a result, they are scarcer than money.

Therefore, the property maintains its value while the money loses each year. So, in reality, what appears to be appreciating is only maintaining its value over time.

Real estate market: store of value

When this happens, is it worth it for the person who has money to leave their money in dollars or any other currency or buy a property? Obviously buying a property is the most sensible measure, as at least it retains its value over time.

And it’s not just real estate that has this function: gold is traditionally a store of value, as much as bonds, which is when you lend your money to the government or a company in exchange for predictable profitability.

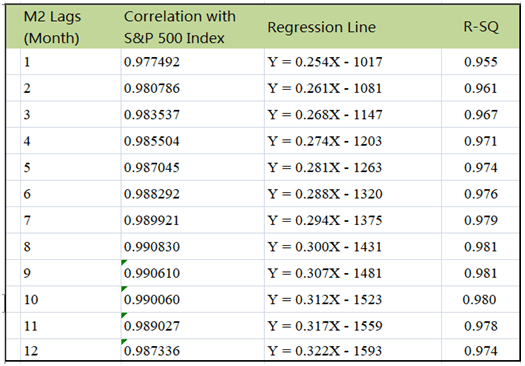

Other people also invest in the stock market, but it’s curious: since 2008 (subprime crisis), when you compare the appreciation of the American stock market with the increase in the monetary base, you notice that their relation is quite close.

Man Yin To, author of a Seeking Alpha article, made a statistical correlation that shown a R² of 0.98 between both (the closer to 1, the bigger the relation between the two variables):

In other words: even when you take more risk by buying shares, you are only maintaining the value of your money, and not making a real profit.

Bitcoin as the ultimate store of value

However, there is an asset that can be truly scarce and is therefore capable of maintaining its real purchasing power: Bitcoin. In Bitcoin, there will only be 21 million units and nothing else.

In order to issue more than 21 million bitcoins, all copies of the network (called Bitcoin nodes) must agree to this change. And what are the chances of everyone agreeing? Let’s see:

First, you need to understand one point: to run a bitcoin node, all you need is a hard drive with enough space and a computer. Nowadays, even a Raspberry Pi already runs a bitcoin node perfectly. Therefore, it is relatively low cost and regular people can run it – contrary to what happens with other networks, which requires huge computing power.

Anyone who usually runs a Bitcoin node is a person or institution that strongly believes in the technology and, presumably, already has a reasonable amount of capital accumulated in Bitcoin. Therefore, they have no incentive to increase the amount of Bitcoin in existence – after all, if they did that, it would dilute the value of their own money.

With this, Bitcoin becomes the best possible store of value for those who want to save money for the long term, as its assets remain constant.

When the owners of management companies, investment funds and large investors realize that Bitcoin is a store of value that does not require payment of property taxes, does not require maintenance and does not require negotiation with tenants, it is natural that they will prefer to exchange their properties for Bitcoin.

Conclusion: it’s still too early to start accumulating BTC. You’re arriving early and drinking clean water. Enjoy.

Recommended Material

Bitcoin Standard, Saifedean Ammous

SAYLOR Today: The BITCOIN Gold Rush Starts Now (Link)